Does Garden Fences Fall Under The Coverage of Home Insurance

Many of us enjoy planting our favorite flowers in our gardens, adorning them with ornaments from our go-to garden center, and setting up patio sets for summertime outside dining. All those little details add up when you include the tools and equipment required to maintain its pristine appearance. However, garden insurance, including garden equipment and furniture coverage, isn’t something most of us consider.

Thankfully, you can safeguard your outdoor space from theft and damage with a garden cover included in many house insurance policies.

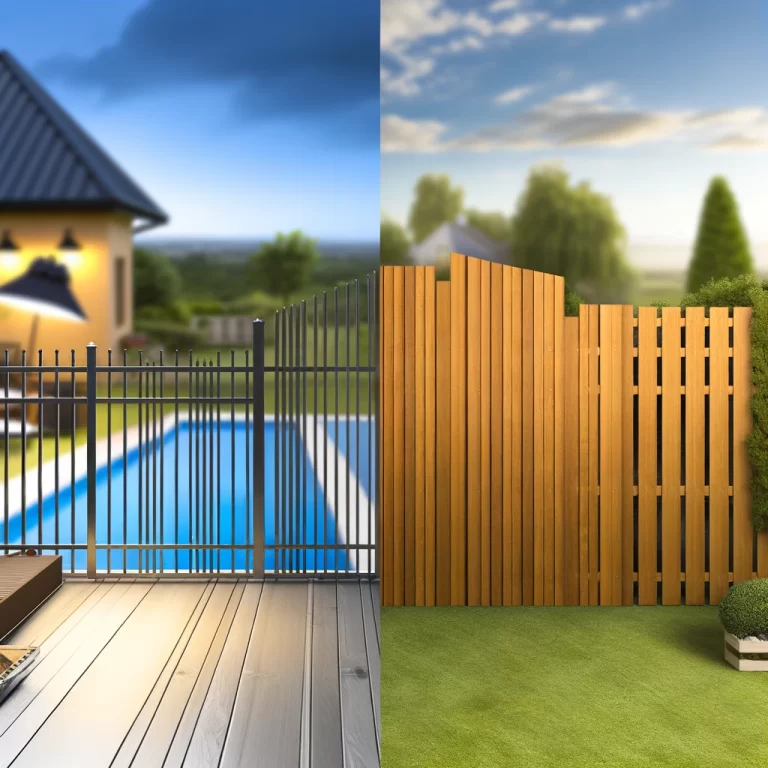

Garden Fence Coverage

When you add your garden fence to your home insurance policy, it and other garden furniture will be protected just like any other part of your property. Given the importance of garden fences in preventing trespassers, theft, and damage from natural disasters and other catastrophes, many homeowners are concerned about whether or not their normal house insurance policy covers them.

There are usually two major types of this coverage:

- Your home’s framework, comprising its walls, roof, and, typically, garden fences and gates, can be protected with building insurance. Most building insurance policies cover a wide variety of risks, including but not limited to fire, flooding, subsidence, vandalism, and storms.

- Homeowners, apartment, and condominium contents insurance typically pays to replace or repair damaged or stolen furniture, appliances, and other personal property, including garden equipment and garden furniture. Garden fences, on the other hand, are typically not covered since they are seen as an integral feature of the property.

Understanding the Coverage: A Closer Look

Home insurance policies, serving as a safety net, are designed to catch us in the event of unforeseen circumstances, including fence damage. However, the extent of this net, especially regarding garden equipment and furniture, and what it encompasses can vary significantly from one policy to another. When it comes to garden fences, the answer to whether they’re covered is not a simple yes or no but rather a, “It depends.”

1. The Type of Damage: Not All are Equal

Most home insurance policies differentiate between types of damage, such as natural disasters versus fence damage due to lack of maintenance. Commonly covered events by home insurance cover include fire, theft, and sometimes, storm damage to fences and gates. However, the devil is in the details. For example, while storm damage might be covered, the specifics can vary. If a storm brings a tree down onto your fence, some insurers might cover it under home insurance cover, but if the wind simply blows your fence over, you might find yourself out of luck. It’s essential to read the fine print in your policy documents and understand what scenarios your policy covers.

2. Wear and Tear: A Common Exclusion

Insurance is intended for sudden and unforeseen damage, not maintenance or the natural wear and tear that occurs over time. If your fence falls because it’s old or hasn’t been properly maintained, insurers typically won’t cover the repair or replacement costs, emphasizing the need for coverage specific to fences and gates. This emphasizes the importance of regular maintenance and timely repairs to extend the life of your fences and gates.

3. The Value of Add-Ons: Comprehensive Coverage

Some homeowners opt for add-ons to their standard insurance policies for more comprehensive coverage. Garden cover is an add-on that can extend your policy to include garden-related structures like fences, sheds, and sometimes even plants. If your garden is your pride and joy, or if you’ve invested significantly in its structures, including fences and gates, considering this additional coverage might be wise.

4. Making a Claim: What to Expect

If your fence has been damaged and you believe it falls under your home insurance coverage, the first step is to contact your insurer. Be prepared with details of the damage, how it occurred, and any relevant photos or documentation, including policy documents from your insurance provider. It’s also important to note that claiming for minor damages, such as fence damage, might not always be in your best interest, considering the potential increase in future premiums or the loss of no-claims bonuses.

Contact Maintenance Free Garden

Knowing your policy details is essential when it comes to house insurance. Although garden fences may be covered by house insurance, this depends on several circumstances, such as the kind of damage, your policy details, and if you have supplemental garden coverage. Your garden fence and peace of mind can last longer with regular upkeep and a clear grasp of the conditions of your policy. Thus, before the next storm builds, check your policy and make sure your garden’s borders are as well-established in the paper as in the ground.

Contact Maintenance-Free Garden to get further details!